Integrating with SecurePay

Getting started with SecurePay is quick and easy, and there are multiple ways you can integrate based on your needs. You also have the chance to test your integration after signing up for an account. SecurePay provides you with a sandbox version, allowing you to freely test SecurePay on your website for as long as you’d like before starting with a live account.

The methods in which you can integrate with SecurePay include SecurePay API, e-Commerce extensions and other methods such as XML, SecureFrame, SecureBill and more.

To find out more on each of the integration methods available, click on the links below.

SecurePay API

The SecurePay API allows you to take payments on your web site in a PCI DSS compliant manner whilst retaining a much greater degree of control over the look & feel than is possible with other payment integrations.

Getting started

Obtaining a SecurePay test account

To obtain your test credentials, you must first create an account with SecurePay. If you’d like to do this now, follow this link to the SecurePay home page and sign up for free.

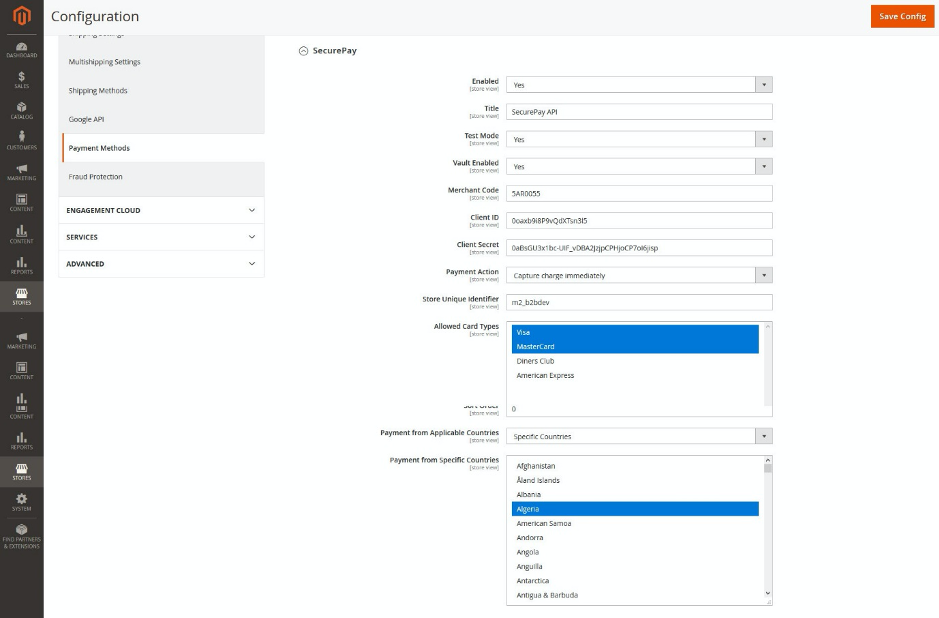

After entering your details, you’ll be given a clientId, a clientSecret and a merchantCode.

These are your test credentials, which you can use to explore SecurePay API’s functionality and integration for free before you start trading.

Giving SecurePay API a test run

Along with your clientId and your clientSecret, you will also have been issued a merchantCode, which you will need to access the sandbox environment where SecurePay can be tested.

To test the SecurePay API and get a feel for how everything works, simply have your credentials ready and access the sandbox environment .

Setting up your live account

Once you’re ready, you can return to your SecurePay account and apply for your merchant account/facility.

After approval, you’ll receive a welcome email providing access to your merchant portal.

After logging in, you’ll notice an activated status letting you know that you’re all set up and ready to integrate our API onto your live site!

You will also find your live clientSecret.

SecurePay will use this to confirm data exchanges (sensitive information) with you as a merchant, so keep it safe and secure!

Environment details

To consume SecurePay API you will need an accessToken to authenticate, refer to the authentication section for more information.

| Environment | Base URL |

|---|---|

| Sandbox | https://payments-stest.npe.auspost.zone |

| Live | https://payments.auspost.net.au |

Authentication

Overview

SecurePay API uses the OAuth 2.0 protocol for authentication and authorization.

Your client application requests an access token from the Authorization Server, and sends the token as part of the Authorization Header to the SecurePay API resource that you want to access.

OAuth 2.0 is used by the world’s largest digital organisations, and it is currently the most secure and technologically advanced protocol of its kind. It uses fast-expiring access tokens that can only be utilised for specific resources by applications. This greatly mitigates the risk of “man-in-the-middle” attack and data breaching.

Client Credentials

Example code to obtain an access token:

curl -X POST \

https://welcome.api2.sandbox.auspost.com.au/oauth/token \

--header 'Authorization: Basic xxxxxxxx' \

--header 'Content-Type: application/x-www-form-urlencoded' \

--data-urlencode 'grant_type=client_credentials' \

--data-urlencode 'audience=https://api.payments.auspost.com.au'

{

"access_token": "eyJraWQiOiJJTzdwOUxNcEd0NBlLLV80Q192SFUyaUFvcGJoMXNZQ0JCOTV5cEthVzBJIiwiYWxnIjoiUlMyNTYifQ.eyJ2ZXIiOjEsImp0aSI6IkFULkFSdUVqbmdlcmJFWHZ1M1ZEMGMzZjNjWDM3OWJzZzhzeElmTmZXNUttSGsiLCJpc3MiOiJodHRwczovL2Rldi00MjQ4ODMub2t0YS5jb20vb2F1dGgyL2RlZmF1bHQiLCJhdWQiOiJhcGk6Ly9kZWZhdWx0IiwiaWF0IjoxNTYwNDAyMjQ0LCJleHAiOjE1NjA0ODg2NDQsImNpZCI6IjBvYW9rYXp4eTB2OEs5UGRVMzU2Iiwic2NwIjpbImh0dHBzOi8vYXBpLnBheW1lbnRzLmF1c3Bvc3QuY29tLmF1L3BheWhpdmUvbWFuYWdlLWFjY291bnRzL3JlYWQiLCJodHRwczovL2FwaS5wYXltZW50cy5hdXNwb3N0LmNvbS5hdS9wYXloaXZlL21hbmFnZS1hY2NvdW50cy93cml0ZSJdLCJzdWIiOiIwb2Fva2F6eHkwdjhLOVBkVTM1NiJ9.Zsv-NGEIUOOucmFl4_a2-E_Kd9GrlRuWvzwwYoU2s8C84PE1dFUzAIoXAs29jPYL3Ceu4t_TtKbm92VG_Oyd85-_pk7nYIli-1SxNSHwIcF8bNMV-mNngXEhjLA_Qm6eT-Ydj6k8Ww47XiDa8fYz48FMmi6f4zU44sEPL3wbNsPTIYEcQxzyO8gPpiKHn-74Gc7XVmFRAKngHr-3WrySevS8CzTlxdk3YJG60LHaivsXoAQ0vaREe4SaTwjlIaxLqfqVihG0B4o4dOlI9pT8gfhTfyb2QnTcyD16uQlUJuXGzlTZmg57mTwNeKmyFAAsOqKTITie-arizOIAtXqb2Q",

"token_type": "Bearer",

"expires_in": 86400,

"scope": "https://api.payments.auspost.com.au/payhive/payments/read https://api.payments.auspost.com.au/payhive/payments/write https://api.payments.auspost.com.au/payhive/payment-instruments/read https://api.payments.auspost.com.au/payhive/payment-instruments/write"

}

Authentication URL

| Environment | URL |

|---|---|

| Sandbox | https://welcome.api2.sandbox.auspost.com.au/oauth/token |

| Live | https://welcome.api2.auspost.com.au/oauth/token |

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

HTTP Basic Auth header containing your client id and client secret (issued during the on-boarding process). Refer to HTTP Basic Auth for more information. |

| Content-Type | Required |

Should be set to application/x-www-form-urlencoded. |

Request Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| grant_type | String | Required |

The grant_type parameter must be set to client_credentials. |

| audience | String | Required |

The audience parameter must be set to https://api.payments.auspost.com.au. |

Response

| Name | Type | Description |

|---|---|---|

| access_token | String | The access token string as issued by the server. Access_token issued will have permission to invoke all SecurePay API operations. |

| token_type | String | Type of token - bearer |

| expires_in | Integer | The duration of time in seconds the access token is granted for. |

| scope | String | The scopes assigned to the client |

Card Payments

Overview

SecurePay API lives on your website as a customisable User Interface (UI) Component that securely captures customer card details so that payments can be made safely.

Unlike other payment services which will take customers off your website entirely, SecurePay provides a "UI Component" which is embedded on your web page. While we do use a iframe to achieve this, our functionality is entirely customisable. The website owner still retains absolute control over the look and feel of the page.

This means that you can customise your payments page exactly how you wish, maintaining total control of your customer experience while leaving the card security (PCI-DSS) and complexity to us.

UI Component:

Your PCI footprint

Any business that deals with card information is subject to compliance obligations in order to maintain security to a universal standard. This universal standard is referred to as being PCI-DSS compliant.

If your website hosts payment fields, you are within PCI scope. This has several implications for your business, but in summary, it means that you must continuously prove yourself PCI-DSS compliant and live up to a very high security standard.

However, by using the SecurePay integration method, you can minimize your PCI scope significantly. This is because customer card details never actually touch your system, absolving you of any security obligations that you would otherwise be subject to.

This integration method keeps your data secure, reducing your PCI scope without sacrificing the customer end-to-end experience.

Customer payment card data will be handled with consideration to the PCI DSS requirements applicable to SecurePay API as a service provider.

Adding the UI Component

<!-- Include the SecurePay UI Component. -->

<script id="securepay-ui-js" src="https://payments-stest.npe.auspost.zone/v3/ui/client/securepay-ui.min.js"></script>

<!-- Configure the UI component. -->

<script type="text/javascript">

var mySecurePayUI = new securePayUI.init({

containerId: 'securepay-ui-container',

scriptId: 'securepay-ui-js',

clientId: 'YOUR_CLIENT_ID',

merchantCode: 'YOUR_MERCHANT_CODE',

card: { // card specific config options / callbacks

onTokeniseSuccess: function(tokenisedCard) {

// card was successfully tokenised

// here you could make a payment using the SecurePay API (via your application server)

},

onTokeniseError: function(errors) {

// error while tokenising card

}

}

});

</script>

To add the SecurePay UI Component, include the JavaScript client library and configure the component as shown in the example code.

The UI component will render a card capture form, which you can use capture the data from your users in a PCI DSS compliant way.

How it works

(1) The SecurePay UI Component should be initialised on the merchant website within the customer browser. See Javscript SDK - Configuration Object for more information on configuration options.

(2) Once the user has entered their card details, the UI Component's tokenise method needs to be called by the merchant website.

In ddc mode tokenise method should be called after onDCCQuoteSuccess was invoked and customer selected a payment option.

(3) Card information will be tokenised by the SecurePay API.

(4) Tokenised card response is returned to the SecurePay UI Component.

(5) On successful tokenisation, the onTokeniseSuccess will be invoked which includes a token.

Please note that the card token generated is temporary and expires after 30 minutes. This token is a once-off usage token for one successful payment. To make token reusable, please use the Store Payment Instrument endpoint.

(6) (Optional) To utilise 3DS2, upon successful tokenisation, SecurePay's 3DS2 Javascript should be loaded and initialised and callbacks are configured. See 3DS2 Javascript - SDK

(7) (Optional) Trigger the 3DS2 Authentication process

(8) (Optional) Handle the authentication response.

(9) Merchant server should make use of the token to make a payment to SecurePay API. You must make this payment request from your server. (Optional) For payment authenticated with 3DS2, pass the Order Id initiated in Step 6.

Send the following HTTP request to SecurePay API to make an anonymous payment:

POST https://payments-stest.npe.auspost.zone/v2/payments

curl https://payments-stest.npe.auspost.zone/v2/payments -X POST

-H "Content-Type: application/json"

-H "Idempotency-Key: 022361c6-3e59-40df-a58d-532bcc63c3ed"

-H "Authorization: Bearer xxxxxxxx"

-d '{ "merchantCode": "YOUR_MERCHANT_CODE",

"amount": 10000,

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"ip": "127.0.0.1"

}'

A successful payment will receive a response similar to the following:

HTTP/1.1 201 Created

CORRELATION-ID: efa12a94-7dd6-4078-a033-7b47aa7dc616

Cache-Control: no-cache, no-store, max-age=0, must-revalidate

Connection: keep-alive

Content-Type: application/json;charset=UTF-8

{

"createdAt": "2021-07-23T13:00:53.128+10:00",

"amount": 1000,

"status": "paid",

"bankTransactionId": "7002157044",

"customerCode": "anonymous",

"merchantCode": "AAA000DM000",

"ip": "127.0.0.1",

"token": "994634932354242",

"orderId": "efa12a94-7dd6-4078-a033-7b47aa7dc616"

}

(10) SecurePay API will process the anonymous payment and return a payment response

(11) Merchant server should proxy the payment response back to the merchant website so that an appropriate response can be returned to the customer browser.

JavaScript SDK

Environment Details

| Environment | SecurePay UI JavaScript SDK URL |

|---|---|

| Sandbox | https://payments-stest.npe.auspost.zone/v3/ui/client/securepay-ui.min.js |

| Live | https://payments.auspost.net.au/v3/ui/client/securepay-ui.min.js |

How does it work?

<!doctype html>

<html>

<body>

<form onsubmit="return false;">

<div id="securepay-ui-container"></div>

<button onclick="mySecurePayUI.tokenise();">Submit</button>

<button onclick="mySecurePayUI.reset();">Reset</button>

</form>

<script id="securepay-ui-js" src="https://payments-stest.npe.auspost.zone/v3/ui/client/securepay-ui.min.js"></script>

<script type="text/javascript">

var mySecurePayUI = new securePayUI.init({

containerId: 'securepay-ui-container',

scriptId: 'securepay-ui-js',

clientId: 'YOUR_CLIENT_ID',

merchantCode: 'YOUR_MERCHANT_CODE',

card: { // card specific config and callbacks

onTokeniseSuccess: function(tokenisedCard) {

// card was successfully tokenised

}

},

onLoadComplete: function() {

// the SecurePay UI Component has successfully loaded and is ready to be interacted with

}

});

</script>

</body>

</html>

To use the SecurePay UI JavaScript SDK, simply:

- include the JavaScript client library

- add a container element for the UI Component

- configure the UI Component

The securepay-ui.min.js client library should be included in your HTML source as shown in the sample code:

<script id="securepay-ui-js" src="https://payments-stest.npe.auspost.zone/v3/ui/client/securepay-ui.min.js"></script>

The script adds a securePayUI object to the global scope.

The SecurePayUI object has a single public function init which requires a UI Config object as its only argument:

var mySecurePayUI = new securePayUI.init({ ... });

This is where you pass your clientId and other configuration information.

See UI Config Object for more information.

The SecurePay UI Component is inserted into the containerId DOM element when configured correctly.

An error message will be shown in the browser console if the configuration object is invalid.

Public Methods

<button onclick="mySecurePayUI.tokenise();">Submit</button>

<button onclick="mySecurePayUI.reset();">Reset</button>

Two functions are available on the CardPayment object after the UI Component has been created:

- securePayUI.tokenise()

- securePayUI.reset()

These commands are sent to the UI Component using the HTML5 window.postMessage API.

mySecurePayUI.tokenise() will the following action:

- tokenise a new card

mySecurePayUI.reset() will clear the card form fields in Checkout and Add Card view modes.

UI Config Object

<!doctype html>

<html>

<body>

<form onsubmit="return false;">

<div id="securepay-ui-container"></div>

<button onclick="mySecurePayUI.tokenise();">Submit</button>

<button onclick="mySecurePayUI.reset();">Reset</button>

</form>

<script id="securepay-ui-js" src="https://payments-stest.npe.auspost.zone/v3/ui/client/securepay-ui.min.js"></script>

<script type="text/javascript">

var mySecurePayUI = new securePayUI.init({

containerId: 'securepay-ui-container',

scriptId: 'securepay-ui-js',

clientId: 'YOUR_CLIENT_ID',

merchantCode: 'YOUR_MERCHANT_CODE',

card: {

allowedCardTypes: ['visa', 'mastercard'],

showCardIcons: false,

onCardTypeChange: function(cardType) {

// card type has changed

},

onBINChange: function(cardBIN) {

// card BIN has changed

},

onFormValidityChange: function(valid) {

// form validity has changed

},

onTokeniseSuccess: function(tokenisedCard) {

// card was successfully tokenised or saved card was successfully retrieved

},

onTokeniseError: function(errors) {

// tokenization failed

}

},

style: {

backgroundColor: 'rgba(135, 206, 250, 0.1)',

label: {

font: {

family: 'Arial, Helvetica, sans-serif',

size: '1.1rem',

color: 'darkblue'

}

},

input: {

font: {

family: 'Arial, Helvetica, sans-serif',

size: '1.1rem',

color: 'darkblue'

}

}

},

onLoadComplete: function () {

// the UI Component has successfully loaded and is ready to be interacted with

}

});

</script>

</body>

</html>

| Option | Type | Required | Description |

|---|---|---|---|

| containerId | string | Yes | The HTML element id where the UI Component is to be inserted |

| mode | string | No | Supported modes are checkout and dcc. Default mode is the checkout mode, it allows payment in AUD currency.dcc mode provides customers with an option to pay in a currency of the card used for payment. Read more in about dcc mode in Dynamic Currency Conversion section. |

| scriptId | string | Yes | The HTML <script> element id which references securepay-ui.min.js |

| clientId | string | Yes | Your client id |

| merchantCode | string | Required if you have multiple merchant codes associated with your account | |

| card | card-object | Yes | Specify card specific configuration options and callbacks |

| style | style-object | Override default styles (background-color, font-size, font-weight, color) | |

| checkoutInfo | checkout-info-object | Conditional | Should be present for in dcc mode. |

Card Object

| Option | Type | Required | Description |

|---|---|---|---|

| allowedCardTypes | string[] | Specify which card types are allowed e.g. [visa, mastercard, amex, diners] |

|

| showCardIcons | boolean | Whether card type icons should be shown (false by default) |

Style Object

| Option | Type | Required | Description |

|---|---|---|---|

| backgroundColor | string | Configure the backgroundColor of the UI component. Eg: white #FFFFFF |

|

| label | style-element-object | Configure the fontFamily fontSize color of the label form fields. |

|

| input | style-element-object | Configure the fontFamily fontSize color of the input form fields. |

Style Element Object

| Option | Type | Required | Description |

|---|---|---|---|

| font | font-object | Configure the styling for the fontobject of the element. |

Font Object

| Option | Type | Required | Description |

|---|---|---|---|

| family | string | Configure the font-family of the font for the element. Eg: "Times New Roman", Times, serif |

|

| size | string | Configure the font-size of the font for the element. Eg: 1.25em 12px 10pt |

|

| color | string | Configure the color of the font for the element. Eg: white #FFFFFF |

Checkout Info Object

| Option | Type | Required | Description |

|---|---|---|---|

| orderToken | string | Conditional | Should be present for in dcc mode. A JWT token from Order Details. |

Dynamic Currency Conversion

Example of UI Component configured for dcc mode

<!doctype html>

<html>

<body>

<form onsubmit="return false;">

<div id="securepay-ui-container"></div>

<button onclick="mySecurePayUI.tokenise();">Submit</button>

<button onclick="mySecurePayUI.reset();">Reset</button>

</form>

<script id="securepay-ui-js" src="https://payments-stest.npe.auspost.zone/v3/ui/client/securepay-ui.min.js"></script>

<script type="text/javascript">

var mySecurePayUI = new securePayUI.init({

containerId: 'securepay-ui-container',

scriptId: 'securepay-ui-js',

mode: 'dcc',

checkoutInfo: {

orderToken: 'YOUR_JWT_TOKEN_FOR_THIS_ORDER'

},

clientId: 'YOUR_CLIENT_ID',

merchantCode: 'YOUR_MERCHANT_CODE',

card: {

allowedCardTypes: ['visa', 'mastercard'],

showCardIcons: false,

onCardTypeChange: function(cardType) {

// card type has changed

},

onBINChange: function(cardBIN) {

// card BIN has changed

},

onFormValidityChange: function(valid) {

// form validity has changed

},

onDCCQuoteSuccess: function(quote) {

// dynamic currency conversion quote was retrieved

},

onDCCQuoteError: function(errors) {

// quote retrieval failed

},

onTokeniseSuccess: function(tokenisedCard) {

// card was successfully tokenised or saved card was successfully retrieved

},

onTokeniseError: function(errors) {

// tokenization failed

}

},

style: {

backgroundColor: 'rgba(135, 206, 250, 0.1)',

label: {

font: {

family: 'Arial, Helvetica, sans-serif',

size: '1.1rem',

color: 'darkblue'

}

},

input: {

font: {

family: 'Arial, Helvetica, sans-serif',

size: '1.1rem',

color: 'darkblue'

}

}

},

onLoadComplete: function () {

// the UI Component has successfully loaded and is ready to be interacted with

}

});

</script>

</body>

</html>

Dynamic Currency Conversion (DCC) is a process in which your customers can make payments on their credit card in the card’s billing currency.

When your customers choose to pay in their own currency For security reasons, do not retrieve a new “access_token”, they lock in the exchange rate at the time of transaction and it remains the same for the lifecycle of the payment.

Supported currencies are: USD, EUR, NZD, GBP, IDR, CRC, COP, BRL, JMD, ZAR, PHP, ARS, INR, AED, CLP, TTD, UYU, MXN, GYD, HKD, GTQ, JPY, SGD, CHF, NOK, MYR, BBD, TZS, QAR, CAD.

Supported card types are: Visa and Mastercard.

Once your customer enters ten digits of their card number, the dynamic currency conversion quote will be retrieved by the SecurePay UI Component. If a quote is available for the card currency, exchange rate details are displayed to the customer. Customer can choose whether to pay in AUD or in the card currency.

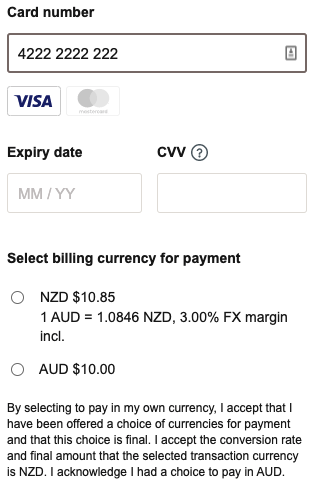

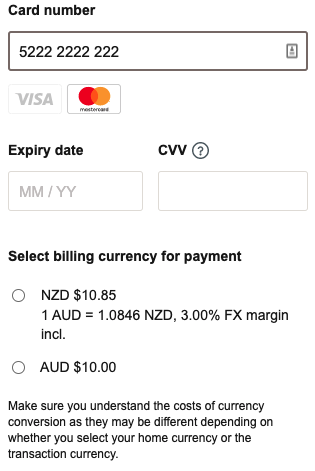

The view of UI Component is slightly different depending on card type, see the examples below.

Example for Visa card

Example for Mastercard card

Prior to loading the UIComponent, a payment order should be initiated by calling Initiate Payment Order from merchant server.

orderToken should be passed from merchant server to merchant website and used to configure UI Config Object.

With DCC tokenise method should be called after onDCCQuoteSuccess was invoked

and Tokenised Card Object will always contain DCC Quote Object.

If your customer chooses to pay in their card’s issued currency which is not AUD, then the converted object in DCC Quote Object will contain foreign currency and amount to charge the customer.

If customer chooses option to pay in AUD, then base field will be present. In this case merchant should charge customer with AUD amount and currency.

DCC receipt format

(1) Must say "Original Transaction Amount" and amount must have AUD prefix

(2) Must say "FX Rate 1 AUD" and show currency code and exchange rate that was returned in Tokenised Card Object in dccQuote.converted.currency and dccQuote.converted.exchangeRate.value fields respectively.

(3) Must say "Including X% margin", where X is taken from dccQuote.converted.exchangeRate.value field returned in Tokenised Card Object

(4) Must say "Final Transactional Amount". Must use foreign currency amount returned in amount field of Payment Object.

Must prefix the amount with foreign currency code, eg. USD taken from currency field of Payment Object.

(5) Must say verbatim "This currency conversion has been provided by Merchant Name. I have been offered a choice of currencies for payment including AUD and agree to pay in USD", using foreign currency code for this transaction (eg. USD). It is advised to develop this text as a parameter so it can easily be changed in the future.

Callbacks

...

onTokeniseSuccess: function(tokenisedCard) {

console.log(tokenisedCard);

}

...

The UI Component sends messages to the client code when various events occur - such as a successful response being received

from a call to securePayUI.tokenise(). These events can be handled by adding callback handler functions to the UI Config object.

The following callbacks are available:

Global SDK Callbacks

| Option | Mode | Description |

|---|---|---|

| onLoadComplete() | checkout, dcc | Invoked when the UI Component has loaded |

| onLoadError() - Deprecated | checkout, dcc | Invoked when the UI Component did not load successfully |

Card SDK Callbacks

| Option | Mode | Description |

|---|---|---|

| onCardTypeChange(cardType) | checkout, dcc | Invoked when card type changes. Returns the card type ('visa', 'mastercard', 'amex' or 'diners' or 'unknown' if type cannot be determined). |

| onCardBINChange(cardBIN) | checkout, dcc | Invoked when BIN changes. Returns the card BIN (Bank Identification Number). |

| onFormValidityChange(valid) | checkout, dcc | Invoked when card form validity state changes. Returns a boolean flag indicating form validity. |

| onDCCQuoteSuccess(dccQuoteDetails) | dcc | Could be invoked in dcc mode only. Invoked, when quote retrieval of dynamic currency conversion is successful. securePayUI.tokenise() should not be invoke prior receiving this callback, otherwise securePayUI.tokenise() call result in DCC_QUOTE_IN_PROGRESS error provided in onTokeniseError callback. |

| onDCCQuoteError(error) | dcc | Could be invoked in dcc mode only. Invoked, when quote retrieval fails, for instance when orderToken is invalid. securePayUI.tokenise() method should not be invoked until UI component is reinitialised with valid configuration details. |

| onTokeniseSuccess(tokenisedCard) | checkout, dcc | Invoked when card is successfully tokenised. Returns the Tokenised Card that was created. |

| onTokeniseError(error) | checkout, dcc | Invoked when card tokenization failed |

Tokenised Card Object

Tokenise Card Object in checkout mode

{

"merchantCode": "YOUR_MERCHANT_CODE",

"token": "520592516621111",

"createdAt": "2021-07-23T13:00:53.128+10:00",

"scheme": "visa",

"bin": "411111",

"last4": "111",

"expiryMonth": "10",

"expiryYear": "20"

}

Tokenise Card Object in dcc mode when customer chose to pay in card currency

{

"merchantCode": "YOUR_MERCHANT_CODE",

"token": "520592516621111",

"createdAt": "2021-07-23T13:00:53.128+10:00",

"scheme": "visa",

"bin": "411111",

"last4": "111",

"expiryMonth": "10",

"expiryYear": "20",

"dccQuote": {

"converted": {

"currency": "USD",

"amount": "1285",

"exchangeRate": {

"value": "1.0946",

"markup": "3.50"

}

}

}

}

Tokenise Card Object in dcc mode when customer chose to pay in AUD

{

"merchantCode": "YOUR_MERCHANT_CODE",

"token": "520592516621111",

"createdAt": "2021-07-23T13:00:53.128+10:00",

"scheme": "visa",

"bin": "411111",

"last4": "111",

"expiryMonth": "10",

"expiryYear": "20",

"dccQuote": {

"base": {

"currency": "AUD"

}

}

}

| Name | Description |

|---|---|

| merchantCode | If you're collecting payments on behalf of other merchants (e.g. Post Bill Pay), this parameter allows you to uniquely identify the merchant. |

| token | A tokenised payment instrument reference. Use this token in make payment call. Please note that the card token generated is temporary and expires after 30 minutes. This token is a once-off usage token for one successful payment. To make the token reusable, please use Store Payment Instrument endpoint. |

| createdAt | A timestamp when card was tokenised, in ISO Date Time format with offset from UTC/Greenwich e.g. 2021-07-23T13:00:53.128+10:00. |

| scheme | A card scheme, e.g. visa, mastercard, diners, amex. |

| bin | Bank identification number. |

| last4 | The last 3 digits of the card number. (Please note the number of digits returned may vary due to the card scheme) |

| expiryMonth | Two digit number representing the card expiry month. |

| expiryYear | Two digit number representing the card expiry year. |

| dccQuote | Dynamic currency conversion quote, will be present in dcc mode only. |

DCC Quote Object

Returned in dccQuote object in Tokenised Card Object

| Name | Description |

|---|---|

| base.currency | Present if customer chose to pay in AUD or conversion rate was unavailable. Supported value: AUD. |

| converted | Present if customer chose to pay in card currency which is not AUD, contains foreign currency and amount to charge the customer. Refer to Converted Object for field details. |

DCC Quote Details Object

Returned on successful quote retrieval in onDCCQuoteSuccess callback

DCC quote details object

{

"base": {

"currency": "AUD"

},

"converted": {

"currency": "USD",

"amount": "1285",

"exchangeRate": {

"value": "1.0946",

"markup": "3.50"

}

}

}

| Name | Description |

|---|---|

| base.currency | Contains the original currency for the order. Supported value: AUD. |

| converted | If present contains details of dynamic currency conversion rate that will be presented to the customer. See Converted Object for details. |

Converted Object

| Name | Description |

|---|---|

| currency | Populated with card currency. |

| amount | Populated with converted amount in card currency in a lower denomination. |

| exchangeRate | Populated with Exchange rate. |

Exchange rate object

| Name | Description |

|---|---|

| value | Exchange rate that was retrieved for a card currency. |

| markup | An agreed upon markup value added to the initial AUD amount before conversion, which is charged to the customer upon final payment. |

Error Object

{

"errors": [

{

"id": "1a909ec1-c96c-4ced-a471-d145a0e517ef",

"code": "MIN_CONSTRAINT_VIOLATION",

"detail": "must be greater than or equal to 1",

"source": {

"pointer": "amount"

}

}

]

}

| Name | Required | Description |

|---|---|---|

| id | Yes |

Unique identifier for the error |

| code | Yes |

Endpoint specific error code |

| detail | Yes |

Detailed error description |

| source.pointer | No |

If error is related to specific field in request this param will be populated with field name |

Rest API

To make a payment, use this code:

POST https://payments-stest.npe.auspost.zone/v2/payments

curl https://payments-stest.npe.auspost.zone/v2/payments -X POST

-H "Content-Type: application/json"

-H "Idempotency-Key: 022361c6-3e59-40df-a58d-532bcc63c3ed"

-H "Authorization: Bearer xxxxxxxx"

-d '{ "amount": 10000,

"merchantCode": "YOUR_MERCHANT_CODE",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"ip": "127.0.0.1",

"orderId": "0475f32d-fc23-4c02-b19b-9fe4b0a848ac"

}'

{

"createdAt": "2021-07-23T13:00:53.128+10:00",

"merchantCode": "YOUR_MERCHANT_CODE",

"customerCode": "anonymous",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"ip": "127.0.0.1",

"amount": "10000",

"currency": "AUD",

"status": "paid",

"orderId": "0475f32d-fc23-4c02-b19b-9fe4b0a848ac",

"bankTransactionId": "de305d54-75b4-431b-adb2-eb6b9e546014",

"gatewayResponseCode": "00",

"gatewayResponseMessage": "Transaction successful"

}

Example of declined payment:

POST https://payments-stest.npe.auspost.zone/v2/payments

curl https://payments-stest.npe.auspost.zone/v2/payments -X POST

-H "Content-Type: application/json"

-H "Idempotency-Key: 022361c6-3e59-40df-a58d-532bcc63c3ed"

-H "Authorization: Bearer xxxxxxxx"

-d '{ "amount": 10051,

"merchantCode": "YOUR_MERCHANT_CODE",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"ip": "127.0.0.1",

"orderId": "0475f32d-fc23-4c02-b19b-9fe4b0a848ac"

}'

{

"createdAt": "2021-07-23T13:00:53.128+10:00",

"amount": 10051,

"currency": "AUD",

"status": "failed",

"bankTransactionId": "824565",

"gatewayResponseCode": "51",

"gatewayResponseMessage": "Not sufficient funds",

"errorCode": "INSUFFICIENT_FUNDS",

"customerCode": "anonymous",

"merchantCode": "YOUR_MERCHANT_CODE",

"ip": "127.0.0.1",

"token": "1117760467699043",

"orderId": "6f3e0642-187d-46b3-9f9f-1af3d8e344a0"

}

Create Payment

Make a payment for a given card token.

Token for anonymous payments expires after 30 minutes.

HTTP Request

POST https://payments-stest.npe.auspost.zone/v2/payments

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Idempotency-Key | Optional |

This key allows a client to safely retry the payment request if it fails to receive a response from the server, e.g. due to a network connection error, etc. The server guarantees to process a payment only once if the same key is used across multiple transactions. It is important for the client to generate random keys, hence the use of UUIDs is strongly encouraged but not enforced by the application. If not passed orderId will be used as Idempotency-Key. |

| Content-Type | Required |

Should be set to application/json. |

Request Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| merchantCode | String | Required |

Merchant account for which the funds are collected. |

| token | String | Required |

A tokenised payment instrument reference. This value is used by the payment gateway to retrieve the actual card information, which is then used to perform the transaction. |

| ip | String | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

| amount | Integer | Required |

An integer value greater than 0, for AUD payments representing the total amount in cents to charge the provided (tokenised) payment instrument. For dynamic currency conversion payments this field should be set to the value of dccQuote.amount field provided in tokenise card object. |

| currency | String | Optional |

Payment currency. Default value is AUD. Non AUD payments are supported for dynamic currency conversion payments only. For dynamic currency conversion payments this field should be set to the value of dccQuote.currency field provided in tokenise card object. |

| orderId | String | Optional |

A client order id, will be used as reference to the payment. If not provided, SecurePay API will assign a unique id for the order. Note: < > " characters are not allowed in orderId. |

| customerCode | String | Optional |

A unique (within your organisation) identifier of your customer. Should not be longer than 30 characters. This is used when you want to perform a payment against a stored payment instrument. Please note anonymous is a reserved keyword and must not be used. |

| fraudCheckDetails | String | Optional |

A payment fraud check details object. |

| dccDetails | Object | Optional |

A dynamic currency conversion details object. Should be present for dynamic currency conversion payments. |

| threedSecureDetails | Object | Optional |

A 3DS2 details Object. Required for payments authenticated with 3DS2. |

Response

The Payment that was successfully created.

Refund Payment

Used to refund a previous payment. Can only be used for AUD transactions.

For DCC transactions, only full refunds are supported and are only available via the SecurePay Merchant Portal.

To refund payment, use this code:

POST https://payments-stest.npe.auspost.zone/v2/orders/{orderId}/refunds

curl https://payments-stest.npe.auspost.zone/v2/orders/{orderId}/refunds -X POST

-H "Content-Type: application/json"

-H "Authorization: Bearer xxxxxxxx"

-d '{ "amount": 10000,

"merchantCode": "YOUR_MERCHANT_CODE",

"ip": "127.0.0.1"

}'

{

"createdAt": "2021-07-23T13:00:53.128+10:00",

"merchantCode": "YOUR_MERCHANT_CODE",

"customerCode" : "anonymous",

"amount": 10000,

"status": "paid",

"orderId": "0475f32d-fc23-4c02-b19b-9fe4b0a848ac",

"bankTransactionId": "de305d54-75b4-431b-adb2-eb6b9e546014",

"gatewayResponseCode": "00",

"gatewayResponseMessage": "Approved"

}

HTTP Request

POST https://payments-stest.npe.auspost.zone/v2/orders/{orderId}/refunds

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Content-Type | Required |

Should be set to application/json. |

Path Variables

| Parameter | Description |

|---|---|

| orderId | A customer order id which was successfully processed previously and the merchant now wants to refund it. |

Request Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| merchantCode | String | Required |

Merchant account for which the funds are collected. |

| ip | String | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

| amount | Integer | Required |

An integer value greater than 0, representing the total amount in cents to refund. The amount will be refunded to the same payment instrument from which the payment was made for the order. The amount value to be refunded should be less then or equal to the actual paid amount. |

Response

The Refund that was successfully created.

Create Account Verification Transaction

An account verification is a $0 transaction used to verify the card details and its validity without impacting the customer’s available funds.

To process an Account Verification transaction, use this code:

POST https://payments-stest.npe.auspost.zone/v2/payments/account-verification

curl https://payments-stest.npe.auspost.zone/v2/payments/account-verification -X POST

-H "Content-Type: application/json"

-H "Authorization: Bearer XXXXXXXXXXXX"

-D'{ "merchantCode": "YOUR_MERCHANT_CODE",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"ip": "127.0.0.1",

"orderId": "0475f32d-fc23-4c02-b19b-9fe4b0a848ac"

}'

{

"createdAt": "2021-07-23T13:00:53.128+10:00",

"merchantCode": "YOUR_MERCHANT_CODE",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"ip": "127.0.0.1",

"status": "success",

"orderId": "0475f32d-fc23-4c02-b19b-9fe4b0a848ac",

"gatewayResponseCode": "00",

"gatewayResponseMessage": "Transaction successful"

}

This transaction type is supported by Visa and Mastercard only and available on selected acquiring banks (NAB, ANZ, Westpac Qvalent and Fiserv FDMSA). Refer to SecurePay’s website FAQs for more information.

HTTP Request

POST https://payments-stest.npe.auspost.zone/v2/payments/account-verification

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Content-Type | Required |

Should be set to application/json. |

Request Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| merchantCode | String | Required |

Merchant account for which the Account Verification transaction is processed against. |

| token | String | Required |

A tokenised payment instrument reference. This value is used by the payment gateway to retrieve the actual card information, which is then used to perform the transaction. |

| ip | String | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

| orderId | String | Optional |

A client order id, will be used as reference to the Account Verification. Note: < > " characters are not allowed in orderId. |

| fraudCheckDetails | Object | Optional |

A account verification fraud check details object.. |

Response

The Account Verification that was successfully created.

Create PreAuth/InitialAuth Transaction

Used to pre-authorise a transaction against a token.

A pre-authorisation is used when wanting to reserve funds on a customer's credit card, which is generally held for five to ten business days. The time duration all depends on the cardholder's bank. During that time, you can “complete” the transaction to capture the funds.

To perform a standard pre-authorisation where you will only have the option of capturing the funds, is by passing PRE_AUTH in the preAuthType parameter field of the request.

For merchants that do not know the final amount when the transaction begins, they can process an initial authorisation transaction. An initial authorisation transaction is a flexible pre-authorisation that allows you to increase or decrease the actual amount when it’s known. You can process an initial authorisation transaction by passing INITIAL_AUTH in the preAuthType parameter field of the request. Please note initial authorisation is supported by Visa and Mastercard only, available on selected acquiring banks (NAB, ANZ, Westpac Qvalent and Fiserv FDMSA) and can be used by merchants in certain industry categories. Refer SecurePay’s website FAQs for more information.

To process a pre-auth/initial-auth transaction, use this code:

POST https://payments-stest.npe.auspost.zone/v2/payments/preauths

curl https://payments-stest.npe.auspost.zone/v2/payments/preauths -X POST

-H "Content-Type: application/json"

-H "Authorization: Bearer xxxxxxxx"

-d '{ "amount": 10000,

"preAuthType": "INITIAL_AUTH",

"merchantCode": "YOUR_MERCHANT_CODE",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"ip": "127.0.0.1",

"orderId": "0475f32d-fc23-4c02-b19b-9fe4b0a848ac"

}

{

"createdAt": "2021-07-23T13:00:53.128+10:00",

"merchantCode": "YOUR_MERCHANT_CODE",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"ip": "127.0.0.1",

"amount": "10000",

"status": "paid",

"orderId": "0475f32d-fc23-4c02-b19b-9fe4b0a848ac",

"bankTransactionId": "de305d54-75b4-431b-adb2-eb6b9e546014",

"gatewayResponseCode": "00",

"gatewayResponseMessage": "Transaction successful"

}

To capture a standard pre-auth or initial-auth transaction please go to Capture PreAuth/InitialAuth Transaction.

If you would like to increase or cancel an approved initial-auth transaction, please go to Increase InitialAuth Transaction / Cancel InitialAuth Transaction

HTTP Request

POST https://payments-stest.npe.auspost.zone/v2/payments/preauths

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Content-Type | Required |

Should be set to application/json. |

Request Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| merchantCode | String | Required |

Merchant account for which the funds are collected. |

| preAuthType | String | Optional |

This parameter defines which type of pre-authorisation is performed. Supported types are PRE_AUTH and INITIAL_AUTH. Default value is PRE_AUTH. |

| token | String | Required |

A tokenised payment instrument reference. This value is used by the payment gateway to retrieve the actual card information, which is then used to perform the transaction. |

| ip | String | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

| amount | Integer | Required |

An integer value greater than 0, representing the total amount in cents to charge the provided (tokenised) payment instrument. |

| orderId | String | Optional |

A client order id, will be used as reference to the payment. Note: < > " characters are not allowed in orderId. |

| customerCode | String | Optional |

A unique (within your organisation) identifier of your customer. Should not be longer than 30 characters. This is used when you want to perform a pre-auth payment against a stored payment instrument. Please note anonymous is a reserved keyword and must not be used. |

| fraudCheckDetails | Object | Optional |

A preAuth fraud check details object. |

| threedSecureDetails | Object | Optional |

A 3DS2 details Object. Required for payments authenticated with 3DS2. |

Response

The PreAuth Payment that was successfully created.

Increase InitialAuth Transaction

Used to increase an initial-auth transaction, using its order id.

Increment can't occur after a capture or a full cancellation has already been made.

To Increase an initial-auth transaction, use this code:

POST https://payments-stest.npe.auspost.zone/v2/payments/preauths/{orderId}/increase

curl https://payments-stest.npe.auspost.zone/v2/payments/preauths/69d49ae5-a6f5-4627-8f7d-8f736011d028/increase -X POST

-H "Content-Type: application/json"

-H "Authorization: Bearer xxxxxxxx"

-d '{ "merchantCode": "YOUR_MERCHANT_CODE",

"ip": "127.0.0.1",

"amount": 5000

}'

{

"createdAt": "2020-07-16T14:26:07.401+10:00",

"amount": 5000,

"status": "paid",

"bankTransactionId": "de305d54-75b4-431b-adb2-eb6b9e546014",

"gatewayResponseCode": "00",

"gatewayResponseMessage": "Transaction successful",

"merchantCode": "YOUR_MERCHANT_CODE",

"ip": "127.0.0.1",

"orderId": "564966e8-2d7d-4bce-b0ed-33f26d751ba5"

}

Used to increase a pre-authorisation transaction of type INITIAL_AUTH only.

NOTE:

- Preauth-Increments are only available on Visa or Mastercard and on selected (NAB, ANZ, Westpac Qvalent and Fiserv FDMSA) acquiring banks and can be used by merchants in certain industry categories. Refer to the SecurePay website FAQs for more information.

- For Visa transactions an

Increase InitialAuth Transactionrequest will result in an amount increase only, it will not affect the validity period of the authorisation. The amount passed in anIncrease InitialAuth Transactionrequest should be greater than zero for Visa transactions. - For Mastercard transactions an

Increase InitialAuth Transactionrequest will result in an amount increase and extension of the validity period. To extend the validity period for Mastercard transactions only, you will have to pass a zero value in the amount field of the request.

HTTP Request

POST https://payments-stest.npe.auspost.zone/v2/payments/preauths/{orderId}/increase

Path Variables

| Parameter | Description |

|---|---|

| orderId | The order id used for pre-auth payment. |

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Content-Type | Required |

Should be set to application/json. |

Request Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| ip | String | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

| merchantCode | String | Required |

Merchant account for which the funds are collected. |

| amount | Integer | Required |

An integer value greater than or equal to 0, representing the increase amount. Refer to note section for more details. |

Response

The Increase PreAuth Payment Object that was successfully increased.

Cancel InitialAuth Transaction

Used to cancel an initial-authorisation transaction using its order id.

Cancellation is always for the full or partial amount. Also cancellation can't occur after a capture or a full amount has already been cancelled.

To cancel an initial-auth transaction, use this code:

POST https://payments-stest.npe.auspost.zone/v2/payments/preauths/{orderId}/cancel

curl https://payments-stest.npe.auspost.zone/v2/payments/preauths/69d49ae5-a6f5-4627-8f7d-8f736011d028/cancel -X POST

-H "Content-Type: application/json"

-H "Authorization: Bearer xxxxxxxx"

-d '{ "merchantCode": "YOUR_MERCHANT_CODE",

"ip": "127.0.0.1",

"amount": 5000

}'

{

"merchantCode": "YOUR_MERCHANT_CODE",

"ip": "127.0.0.1",

"orderId": "d2b65e49-e163-43ca-bd72-78dafsfe79-78g1d4c23",

"amount": 5000,

"gatewayResponseCode": "00",

"gatewayResponseMessage": "Transaction successful"

}

Used to cancel pre-authorisation payment of type INITIAL_AUTH only.

NOTE:

Preauth-Cancellations are only available on Visa or Mastercard and on selected (NAB, ANZ*, Westpac Qvalent and Fiserv FDMSA) acquiring banks and can be used by merchants in certain industry categories. Refer to the SecurePay website FAQs for more information.

* The ANZ acquirer doesn’t currently support partial cancellations, only full cancellations can be made.

HTTP Request

POST https://payments-stest.npe.auspost.zone/v2/payments/preauths/{orderId}/cancel

Path Variables

| Parameter | Description |

|---|---|

| orderId | The order id used for pre-auth payment. |

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Content-Type | Required |

Should be set to application/json. |

Request Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| ip | String | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

| merchantCode | String | Required |

Merchant account for which the funds are collected. |

| amount | Integer | Optional |

An integer value greater than 0, representing an amount in cents to cancel. If the amount field is not present, the full amount that is left of the initial-authorisation will be cancelled. Refer to note section for more details. |

Response

The Cancel InitialAuth Payment Object that was successfully cancelled.

Capture PreAuth/InitialAuth Transaction

Used to capture a pre-authorisation transaction using its order id. This is applicable for both pre-auth types: PRE_AUTH and INTIAL_AUTH

A capture must be completed for the full amount of the pre-auth, it can't be less (partial capture) or more (over capture). Also capture can only be done once and can't occur after a cancellation has been made.

To capture a pre-auth/initial-auth transaction, use this code:

POST https://payments-stest.npe.auspost.zone/v2/payments/preauths/{orderId}/capture

curl https://payments-stest.npe.auspost.zone/v2/payments/preauths/{orderId}/capture -X POST

-H "Content-Type: application/json"

-H "Authorization: Bearer xxxxxxxx"

-d '{ "amount": 10000,

"merchantCode": "YOUR_MERCHANT_CODE",

"ip": "127.0.0.1"

}'

{

"createdAt": "2021-07-23T13:00:53.128+10:00",

"merchantCode": "YOUR_MERCHANT_CODE",

"ip": "127.0.0.1",

"amount": 1000,

"status": "paid",

"orderId": "d2b65e49-e163-43ca-bd72-78dafsfe79-78g1d4c23",

"bankTransactionId": "731627310",

"gatewayResponseCode": "00",

"gatewayResponseMessage": "Transaction successful"

}

HTTP Request

POST https://payments-stest.npe.auspost.zone/v2/payments/preauths/{orderId}/capture

Path Variables

| Parameter | Description |

|---|---|

| orderId | The order id used for pre-auth payment. |

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Content-Type | Required |

Should be set to application/json. |

Request Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| merchantCode | String | Required |

Merchant account for which the funds are collected. |

| ip | String | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

| amount | Integer | Required |

An integer value greater than 0, representing the total amount in cents to charge the provided (tokenised) payment instrument. Note: The amount has to be equal to the pre-auth txn amount. |

Response

The Capture Payment Object that was successfully created.

Create Payment (Stored Payment Instrument)

To make payment for a customer, use this code:

POST https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payments

curl https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payments -X POST

-H "Content-Type: application/json"

-H "Idempotency-Key: 022361c6-3e59-40df-a58d-532bcc63c3ed"

-H "Authorization: Bearer xxxxxxxx"

-d '{ "amount": 10000,

"merchantCode": "YOUR_MERCHANT_CODE",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"ip": "127.0.0.1",

"orderId": "0475f32d-fc23-4c02-b19b-9fe4b0a848ac"

}'

{

"createdAt": "2021-07-23T13:00:53.128+10:00",

"customerCode": "YOUR_CUSTOMER_CODE",

"merchantCode": "YOUR_MERCHANT_CODE",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"amount": "10000",

"currency": "AUD",

"status": "paid",

"ip": "127.0.0.1",

"orderId": "0475f32d-fc23-4c02-b19b-9fe4b0a848ac",

"bankTransactionId": "de305d54-75b4-431b-adb2-eb6b9e546014"

}

Makes a payment for a logged in customer.

HTTP Request

POST https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payments

Path Variables

| Parameter | Description |

|---|---|

| customerCode | A unique (within your organisation) identifier of your customer. Should not be longer than 30 characters. Please note anonymous is a reserved keyword and must not be used. |

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Idempotency-Key | Optional |

This key allows a client to safely retry the payment request if it fails to receive a response from the server, e.g. due to a network connection error, etc. The server guarantees to process a payment only once if the same key is used across multiple transactions. It is important for the client to generate random keys, hence the use of UUIDs is strongly encouraged but not enforced by the application. If not passed orderId will be used as Idempotency-Key. |

| Content-Type | Required |

Should be set to application/json. |

Request Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| merchantCode | String | Required |

Merchant account for which the funds are collected. |

| token | String | Required |

A tokenised payment instrument reference. This value is used by the payment gateway to retrieve the actual card information, which is then used to perform the transaction. |

| ip | String | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

| amount | Integer | Required |

An integer value greater than 0, representing the total amount in cents to charge the provided (tokenised) payment instrument. |

| orderId | String | Optional |

A client order id, will be used as reference to the payment. Note: < > " characters are not allowed in orderId. |

Response

The Payment that was successfully created.

Initiate Payment Order

Initiates a payment order. A Payment order has to be initiated prior making either a dynamic currency conversion (DCC) payment or a 3DS2 payment request.

The response from this request includes orderId required for Create Payment and orderToken required to retrieve a conversion rate by UI component (DCC) or to request 3DS2 authentication. The response for an 3DS2 order request will also include a threedSecureDetails object with fields required during 3DS2 Authentication i.e. providerClientId, sessionId & simpleToken.

Note that orderToken expires after 10 minutes.

To create a payment order, use this code:

POST https://payments-stest.npe.auspost.zone/v2/payments/orders/initiate

curl https://payments-stest.npe.auspost.zone/v2/payments/orders/initiate -X POST

-H "Content-Type: application/json"

-H "Authorization: Bearer XXXXXXXXXXXX"

-D'{ "merchantCode": "YOUR_MERCHANT_CODE",

"amount": 10000,

"ip": "127.0.0.1",

"orderReference": "Your reference for this order",

"orderType": "DYNAMIC_CURRENCY_CONVERSION"

}'

{

"ip": "127.0.0.1",

"orderReference": "Your reference for this order",

"merchantCode": "YOUR_MERCHANT_CODE",

"orderType": "DYNAMIC_CURRENCY_CONVERSION",

"amount": 10000,

"orderId": "2551d30c-250c-4d9d-afe6-3b6f2cab1ccf",

"orderToken": "YOUR_JWT_TOKEN_FOR_THIS_ORDER",

"createdAt": "2021-02-04T14:01:54.839+11:00"

}

HTTP Request

POST https://payments-stest.npe.auspost.zone/v2/payments/orders/initiate

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Content-Type | Required |

Should be set to application/json. |

Request Parameters

| Parameter | Type | Required | Description |

|---|---|---|---|

| merchantCode | String | Required |

Merchant account for which the funds are collected. |

| ip | String | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

| amount | Integer | Required |

An integer value greater than 0 in AUD, representing the total amount in cents. |

| orderType | String | Required |

A type of the order to create. Currently supported types: DYNAMIC_CURRENCY_CONVERSION or THREED_SECURE. |

| orderReference | String | Optional |

A client order reference, could be used as reference to the order. |

Response

The Order Details that was successfully created.

Create Payment Instrument

Allows management of tokenised payment instruments against organisation's users. This service does not directly manage the users (i.e. there is no "user" resource), that is left up to the consuming application.

To store payment instrument, use this code:

POST https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payment-instruments/token

curl https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payment-instruments/token -X POST

-H "Content-Type: application/json"

-H "Authorization: Bearer xxxxxxxx"

-H "token: de305d54-75b4-431b-adb2-eb6b9e546014"

-H "ip: 127.0.0.1"

{

"createdAt": "2021-07-23T13:00:53.128+10:00",

"customerCode": "YOUR_CUSTOMER_CODE",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"scheme": "visa",

"bin": "424242",

"last4": "242",

"expiryMonth": "01",

"expiryYear": "19"

}

Stores a tokenised payment instrument against a customer identifier within the organisation (the organisation identifier is derived from authentication credentials).

HTTP Request

POST https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payment-instruments/token

Path Variables

| Parameter | Description |

|---|---|

| customerCode | A unique (within your organisation) identifier of your customer. Should not be longer than 30 characters. Please note anonymous is a reserved keyword and must not be used. |

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Content-Type | Required |

Should be set to application/json. |

| token | Required |

A tokenised payment instrument reference. This value is used by the payment gateway to retrieve the actual card information, which is then used to perform the transaction. |

| ip | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

Response

The Payment Instrument Object that was successfully created.

Payment Instruments

To retrieve payment instruments, use this code:

GET https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payment-instruments

curl https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payment-instruments -X GET

-H "Content-Type: application/json"

-H "Authorization: Bearer xxxxxxxx"

-H "ip: 127.0.0.1"

{

"paymentInstruments": [

{

"createdAt": "2021-07-23T13:00:53.128+10:00",

"customerCode": "YOUR_CUSTOMER_CODE",

"token": "de305d54-75b4-431b-adb2-eb6b9e546014",

"scheme": "visa",

"bin": "424242",

"last4": "242",

"expiryMonth": "01",

"expiryYear": "19"

}

]

}

Retrieves stored payment instruments from the vault for an identified customer.

HTTP Request

GET https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payment-instruments

Path Variables

| Parameter | Description |

|---|---|

| customerCode | A unique (within your organisation) identifier of your customer. Should not be longer than 30 characters. Please note anonymous is a reserved keyword and must not be used. |

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Content-Type | Required |

Should be set to application/json. |

| ip | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

Response

The current list of Payment Instrument Object that exist.

Delete Payment Instrument

To delete payment instrument, use this code:

DELETE https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payment-instruments/token

curl https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payment-instruments/token -X DELETE

-H "Content-Type: application/json"

-H "Authorization: Bearer xxxxxxxx"

-H "token: de305d54-75b4-431b-adb2-eb6b9e546014"

-H "ip: 127.0.0.1"

{

"customerCode": "DE8482",

"token": "1da87a11-4242-4163-883b-cded6d839a44",

"deleted": true

}

Deletes a previously stored payment instrument from the vault.

HTTP Request

DELETE https://payments-stest.npe.auspost.zone/v2/customers/{customerCode}/payment-instruments/token

Path Variables

| Parameter | Description |

|---|---|

| customerCode | A unique (within your organisation) identifier of your customer. Should not be longer than 30 characters. Please note anonymous is a reserved keyword and must not be used. |

Header Parameters

| Parameter | Required | Description |

|---|---|---|

| Authorization | Required |

Bearer Access Token. Refer to client credentials for more information on obtaining an access token. |

| Content-Type | Required |

Should be set to application/json. |

| ip | Required |

A customer IP address. Must be a valid IPv4 or IPv6. |

Response

| Name | Type | Description |

|---|---|---|

| customerCode | String | A unique (within your organisation) identifier of your customer. This value is used for security to validate that the logged in customer owns the payment instrument that is to be deleted. |

| token | String | A tokenised payment instrument reference. This value uniquely identifies a payment instrument in the vault. |

| deleted | Boolean | Status of deleted record. This should have a value of true if the record was found and deleted or false if no record matches the request parameters. |

Payment Objects

Payment Fraud Check Details Object

If FraudGuard rules needs to be applied before attempting the payment, fraudCheckType should be populated with FRAUD_GUARD value and relevant order details could be passed in the request.

If the fraud check has been performed via FraudGuard or ACI Red Shield Fraud detection endpoints, the provider reference number of the fraud check result could be passed as a part of payment request.

| Name | Type | Required | Description |

|---|---|---|---|

| providerReferenceNumber | String | Conditional |

The provider reference number returned by FraudGuard or ACI Red Shield Fraud Detection Endpoints can be found in FraudGuard or ACI Red Shield Check Result Objects. |

| fraudCheckType | String | Conditional |

If FraudGuard rules needs to be applied before attempting the payment, fraudCheckType should be populated with FRAUD_GUARD value. |

| customerDetails | Object | Optional |

The Customer Details Object. |

| shippingAddress | Object | Optional |

The Shipping Address Object. |

| billingAddress | Object | Optional |

The Billing Address Object. |

Dynamic Currency Conversion Details Object

Used for dynamic currency conversion payments. Should be passed in dccDetails of Create Payment request.

| Name | Type | Required | Description |

|---|---|---|---|

| initiatedOrderId | String | Required |

Should be passed for dynamic currency conversion payments. Should be populated with dynamic conversion orderId returned in Payment Order Object |

3DS2 Details Object

Used for payments with 3DS2. Should be passed in threedSecureDetails of Create Payment request and Create PreAuth/InitialAuth Transaction requests.

| Name | Type | Required | Description |

|---|---|---|---|

| initiatedOrderId | String | Required |

Should be passed for payments with 3DS2. Should be populated with 3DS2 orderId returned in Payment Order Object |

| liabilityShiftIndicator | String | Optional |

Optional field in Authorisation and Preauthorisation requests that is matched against the Liability Shift Indicator which SecurePay has stored from 3DS2 Authentication Response. |

Liability Shift Indicator

The purpose of this optional field in the authorisation/preauthorisation request is to:

(1) Provide control (and explicit acceptance) of whether to proceed with payments even if the 3DS2 authentication did not pass.

(2) Ensure that there has been no modification to the Liability Shift Indicator you receive in the authentication outcome, and your decision to continue with payment (or cease the payment flow) is based on correct authentication information.

Example #1: Your customer completes the 3DS2 authentication process and the Liability was not shifted, which means you are liable for fraudulent chargebacks. Based on your business reasoning you want to proceed with the payment, you must place a ‘N’ in the liabilityShiftIndicator field in the authorisation request to acknowledge and accept the liability has not been shifted to allow the payment to proceed.

Example #2: Your customer completes the 3DS2 authentication process and the Liability was not shifted. However, a malicious customer modifies the authentication outcome, and you receive an indicator that the liability was shifted to the issuer. You proceed with the payment as you understood it was shifted (but you are still liable for fraudulent chargebacks). As you have sent no value in the liabilityShiftIndicator field, the payment is rejected, protecting you and your customer. The LSI value in the authorisation request must match the Liability Shift Indicator value we have stored for the Authentication outcome. This gives control of proceeding or not proceeding with unauthenticated transactions. To see more details on how the field is sent, please refer to the integration guide for your integration in the developer resources on the SecurePay website. Please refer to the table below for the transaction flow scenarios relating to the liabilityShiftIndicator field:

| SecurePay: Liability shift indicator from Authentication Outcome | Merchant: Liability Shift Indicator Sent in Authorisation Request ‘liabilityShiftIndicator’ | Result |

|---|---|---|

| Y | Y | Payment continues for processing |

| N | N | Payment continues for processing |

| Y | Not Provided | Payment continues for processing |

| N | Y | 3DS2 Payment is declined withResponse Code: 517 Response Text:Liability Shift Indicator |

| Y | N | 3DS2 Payment is declined withResponse Code: 517 Response Text:Liability Shift Indicator |

| N | Not Provided | 3DS2 Payment is declined withResponse Code: 517 Response Text:Liability Shift Indicator |

PreAuth/Account Verification Fraud Check Details Object

If the fraud check has been performed via FraudGuard or ACI Red Shield Fraud detection endpoints, the provider reference number of the fraud check result could be passed as a part of payment request.

| Name | Type | Required | Description |

|---|---|---|---|

| providerReferenceNumber | String | Conditional |

The provider reference number returned by FraudGuard or ACI Red Shield Fraud Detection Endpoints can be found in FraudGuard or ACI Red Shield Check Result Objects. |

Payment Object

A completed payment returned by Create Payment and Create Payment(Stored payment instrument)

| Name | Type | Description |

|---|---|---|

| createdAt | String | A timestamp when transaction was created, in ISO Date Time format with offset from UTC/Greenwich e.g. 2021-07-23T13:00:53.128+10:00. |

| merchantCode | String | Merchant account for which the funds are collected. |

| customerCode | String | The identifier for the customer. In case of anonymous payment it is always anonymous. |

| token | String | The tokenised payment instrument that was used. |

| ip | String | Client IP address. |

| amount | String | Total amount in cents that was charged to the tokenised payment instrument. |

| currency | String | Payment currency. |

| status | String | The status of the payment. Valid values are paid failed unknown. If the payment was processed and succeeded the status field in payload response is set to paid. If payment was processed but was declined the status is set to failed and errorCode field is populated with error code related to reason of decline. If payment was processed with unexpected status from gateway the status is set to unknown and errorCode field is populated with error code related to reason. |

| orderId | String | A client order id, will be used as reference to the payment. Note: < > " characters are not allowed in orderId. |

| bankTransactionId | String | The payment transaction reference from the payment gateway. |

| gatewayResponseCode | String | Bank response code which identifies the reason the transaction was approved or decline. Refer to bank response code for card payments. |

| gatewayResponseMessage | String | Detailed message of the bank response code. |

| errorCode | String | If transaction was processed but declined by the bank or payment was declined due to results of requested FraudGuard check this field is populated with error code representing reason of failure. |

| fraudCheckType | String | If payment request included FraudGuard check this field is populated with FRAUD_GUARD value. |

| fraudCheckResult | Object | If payment request included FraudGuard check this field is populated fraud check result. Refer to Fraud Check Result for more details. |

Account Verification Transaction Object

A completed Account Verification transaction returned by Create Account Verification Transaction

| Name | Type | Description |

|---|---|---|

| createdAt | String | A timestamp when transaction was created, in ISO Date Time format with offset from UTC/Greenwich e.g. 2021-07-23T13:00:53.128+10:00. |

| merchantCode | String | Merchant account for which the Account Verification transaction is processed against. |

| customerCode | String | The identifier for the customer. In case of anonymous payment it is always anonymous. |

| token | String | The tokenised payment instrument that was used. |

| ip | String | Client IP address. |

| orderId | String | A client order id, will be used as reference to the Account Verification. Note: < > " characters are not allowed in orderId. |

| status | String | The status of the payment. Valid values are success or failed. If the verification was processed and succeeded, the status field in payload resonse is set to success. If the verification was processed but was failed, the status is set to failed and errorCode field is populated with error code related to reason of failure. |

| gatewayResponseCode | String | Bank response code which identifies the reason the transaction was approved or decline. Refer to bank response code for card payments. |

| gatewayResponseMessage | String | Detailed message of the bank response code. |

| errorCode | String | If transaction was processed but declined by the bank this field is populated with error code representing reason of failure. |

PreAuth Payment Object

A completed payment returned by Create PreAuth/InitialAuth Transaction

| Name | Type | Description |

|---|---|---|

| createdAt | String | A timestamp when transaction was created, in ISO Date Time format with offset from UTC/Greenwich e.g. 2021-07-23T13:00:53.128+10:00. |

| merchantCode | String | Merchant account for which the funds are collected. |

| customerCode | String | The identifier for the customer. In case of anonymous payment it is always anonymous. |

| token | String | The tokenised payment instrument that was used. |

| ip | String | Client IP address. |

| amount | String | Total amount in cents that was charged to the tokenised payment instrument. |

| status | String | The status of the pre-auth/initial-auth transaction. Valid values are paid failed unknown. If the pre-auth/ initial-auth transaction was processed and successful the status field in payload response is set to paid. If the pre-auth/initial-auth transaction was processed but was declined, the status is set to failed and errorCode field is populated with error code related to reason of decline. If the pre-auth/initial-auth transaction was processed with unexpected status from gateway, the status is set to unknown and errorCode field is populated with error code related to reason. |

| orderId | String | A client order id, will be used as reference to the payment. Note: < > " characters are not allowed in orderId. |

| bankTransactionId | String | The payment transaction reference from the payment gateway. |

| gatewayResponseCode | String | Bank response code which identifies the reason the transaction was approved or decline. Refer to bank response code for card payments. |

| gatewayResponseMessage | String | Detailed message of the bank response code. |

| errorCode | String | If transaction was processed but declined by the bank this field is populated with error code representing reason of failure. |

Cancel InitialAuth Payment Object

A initial-authorisation that was cancelled by Cancel InitialAuth Transaction.

| Name | Type | Description |

|---|---|---|

| merchantCode | String | Merchant account for which the funds are collected. |

| ip | String | Client IP address that was used. |

| amount | String | Total amount in cents that was cancelled. |

| orderId | String | A client order id, will be used as reference to the payment. Note: < > " characters are not allowed in orderId. |

| gatewayResponseCode | String | Bank response code which identifies the reason the transaction was approved or decline. Refer to bank response code for card payments. |

| gatewayResponseMessage | String | Detailed message of the bank response code. |

Capture Payment Object

A completed pre-authorisation capture returned by Capture PreAuth/InitialAuth Transaction.

| Name | Type | Description |

|---|---|---|

| createdAt | String | A timestamp when transaction was created, in ISO Date Time format with offset from UTC/Greenwich e.g. 2021-07-23T13:00:53.128+10:00. |

| merchantCode | String | Merchant account for which the funds are collected. |

| ip | String | Client IP address that was used. |

| amount | String | Total amount in cents that was charged to the tokenised payment instrument. |

| status | String | The status of the pre-auth/initial-auth capture payment. Valid values are paid failed unknown. If the pre-auth/initial-auth capture payment was processed and successful the status field in the payload response is set to paid. If the pre-auth/initial-auth capture payment was processed but was declined the status is set to failed and errorCode field is populated with error code related to reason of decline. If the pre-auth/initial-auth capture payment was processed with an unexpected status from gateway, the status is set to unknown and errorCode field is populated with error code related to reason. |