Our Business

Our network of 4,406 Post Offices mean we are never far away – making it easy for our customers to send, receive and collect their parcels. Our network of more than 200 Parcel Locker locations gives customers even more choice about where and when they collect their goods.

What we do

Read about what we do ›

The building block of eCommerce - deliveries, identity services, payments and trusted communications - are already central to our business. Our combination of Australia Post and StarTrack creates a competitive advantage no one can match.

Read more about the ways our people are central to our eCommerce story.Financial

performance

This year has been an important and transitional one for the Australia Post Group that saw us focus on winning...

Read more about our financial performance ›Engaging our

stakeholders

Australia Post’s stakeholder groups include our workforce, our customers and the broader community.

Read more about engaging our stakeholders ›Our Business

Our network of 4,406 post offices mean we are never far away – making it easy for our customers to send, receive and collect their parcels. Our network of more than 200 Parcel Locker locations gives customers even more choice about where and when they collect their goods.

Our 15,591 street posting boxes mean that even if you live on Horn Island in the Torres Strait, you can post a letter across the world or return your online purchases as easily as someone in a capital city.

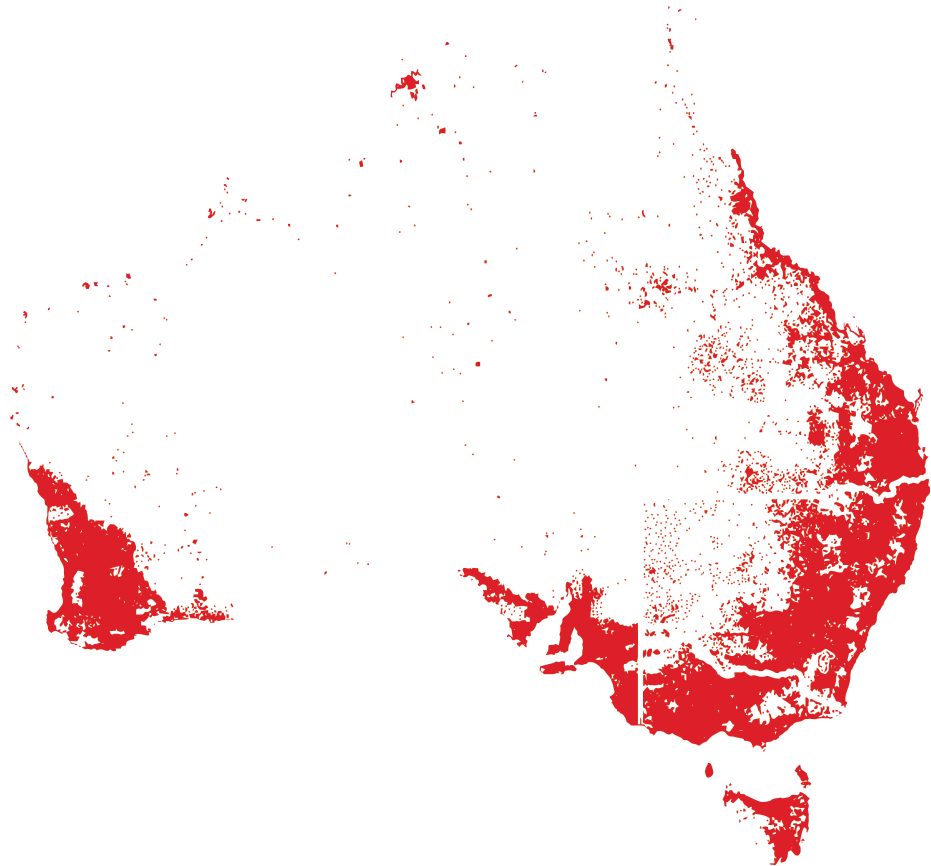

With 11.4m delivery points across the country, we deliver almost everywhere. So, even if you live in Kununurra in WA’s remote Kimberley region, you’ll be on one of our routes.

Asian gateway

We help Australian businesses to reach more than 500m Chinese consumers through our online marketplaces on JD.com and Tmall.

Through our joint venture with China Post, we now offer Australian companies doing business in China with end-to-end supply chain solutions.

Shop like you live

in the USA

Our Shopmate service now allows Australian consumers to make online purchases from retailers who only ship with in the USA.

- •The red highlights on this map, denote the location of our 11.4 million delivery points

in more than 3,832

communities across

the country

200+ Parcel

Locker locations

facilities

connecting

our

network

globally

street

posting

boxes

travelling

more than

350 million kms

and 80+ destinations every

day, we carried more than

74 million kilos of

air freight this year

Engaging

our stakeholders

Australia Post’s stakeholder groups include our workforce, our customers and the broader community as well as regulators, industry and environment groups, peak bodies, and the media.

We understand how important it is that we continue to keep our customers and communities engaged and informed around the decisions we make in our business.

We know that our future success will largely depend on the support of our key stakeholders and we place a high premium on engaging them in the important decisions that shape our future.

Letters reform

This year, our primary focus has centred on a program of events to increase community awareness and understanding of the urgent need to reform our letters business.

In 2014, we launched our Community Engagement Program that enabled us to consult with key groups around the need for reform and understand their views as we moved towards a new pricing and services structure.

Highlights for the year included 197 community events held in 166 locations, with more than 3,180 participants.

National Conversation platform

In June 2014, we launched the National Conversation, our online platform providing the Australian community with an ongoing voice in what the future of Australia Post should look like.

As at 30 June 2015, more than 132,000 Australians had visited this online platform, making 5,510 contributions to the conversation, and giving us important insights into the community’s understanding and acceptance of our business and the need for change.

Our

Stakeholder

Council

One of the key elements of stakeholder engagement is our Stakeholder Council, an external advisory group of nine individuals whose role is to help us improve our communication and engagement with stakeholders.

The council meets three times a year and is chaired by an Australia Post Board member. Council members offer a range of views, representative of their roles and experience in small and medium business, industrial relations, direct marketing and corporate responsibility.

Council members are:

John Bergin

Former Managing Director, Yakka Australia

Sommers Botha

Former General Manager, Retail Scholastic Australia

Helen Christie

Former State President, Country Women’s Association of Victoria

Graz van Egmond

Executive Director, Banksia Environment Foundation

George Etrelezis

Small Business Consultant

Allan Garcia

Chief Executive Officer, Local Government Association Tasmania

(retired from the Stakeholder Council on 20 March 2015)

Dennis Jenner

Director, Post Office Agents Association Limited

Gabrielle Nagle

Child & Family Services consultant

Cameron Thiele

Formerly of the Communications, Electrical and Plumbing Union

Rob Tolmie

Managing Director, R&C Consulting Pty Ltd

Stakeholder Council statement

For several years the Stakeholder Council has had the opportunity to guide and review Australia Post’s approach to best-practice integrated annual and corporate responsibility (CR) reporting. In reviewing the corporation’s fifth integrated annual report this year, we believe that Australia Post has continued to advance its commitment to CR and sustainability. In fact, we commend the efforts to evolve the coverage of the corporation’s material issues and further integrate its social and environmental performance in the 2015 report. This highlights Australia Post’s strategic approach to a whole-of-business and supplychain focus on delivering improved social and environmental outcomes for the Australian community. The Council believes that this report again provides a transparent representation and clearly integrated material in relation to Australia Post’s performance that is accessible to all stakeholders.

Australia Post Stakeholder Council

August 2015

Financial performance

This year has been an important and transitional one for the Australia Post Group that saw us focus on winning Government support for the reform of our letters business, while continuing to align our overall strategy to be a leader in eCommerce.

While our parcels business continues to generate solid revenue growth, this has been offset by an acceleration in letter volume decline resulting from the impact digitisation has had on customer interactions and behaviour.

Performance

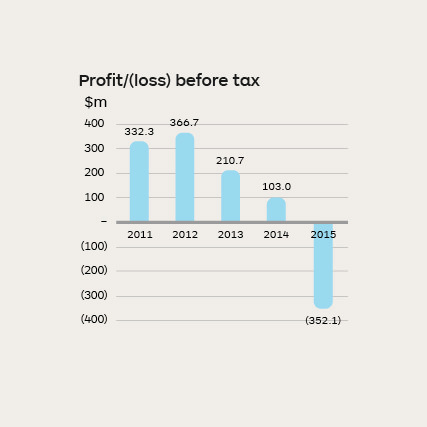

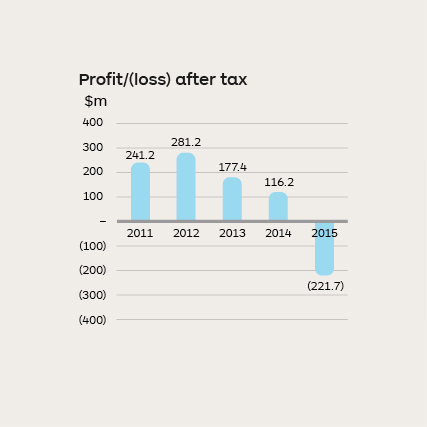

This year the Group’s loss after tax was $221.7 million, our first loss since corporatisation in 1989. This loss included $190.0 million of pre-tax costs relating to the transformational reform of our letters business program.

This reform program will allow the network to improve sequencing of mail, automation, handling, and postal delivery efficiency – while continuing to maintain a five-day-a-week delivery and harnessing the full value of our reserved letters service.

The growth in the internet, the digitisation of technology platforms, and the proliferation of mobile devices have profoundly changed the way consumers, businesses and governments operate. This has impacted both our traditional mail services, and retail and agency services businesses through the continued fall in letter volumes. However, this decrease has been partly offset by the full-year benefit of the Basic Postage Rate increase in March 2014 and the focus on expanding products and services offered through our post offices and digital channels.

Our parcels business has continued to perform strongly with revenue growing year on year, despite a highly competitive market where we have seen domestic freight providers building capacity and international competitors acquiring sorting and last-mile delivery capabilities in Australia.

The financial performance of the Group has also been affected by asset write-offs and impairments of $214.1 million following a comprehensive review of the carrying value of the assets.

Despite the challenges, and funding requirements to restructure, integrate and invest in our business, our strong focus on cash management has resulted in a similar closing cash position to last year.

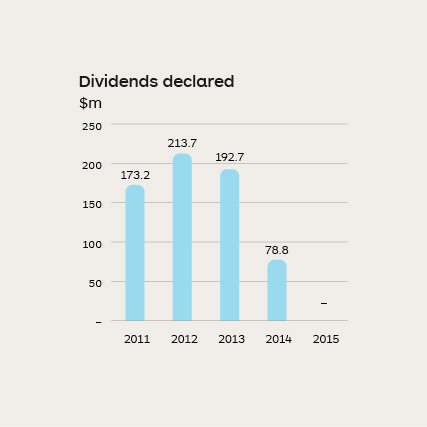

As a result of our Group loss, no dividend will be declared to our shareholder.

Investment

Our total cash investment this year across strategic projects and asset replacement and acquisition was $349.9 million.

The strategic investment has focused on expanding our parcel facilities in Melbourne and Sydney, doubling the processing capacity at those facilities, as well as driving enhancements in our parcel processing and delivery capabilities to continue building a world-class network. A significant investment has also focused on the integration of StarTrack and Australia Post networks to extend product and service offerings across all our customers.

We also continue to invest in the reform of our letters service program to replace our existing ageing equipment with new small letters and flat sorting machines to optimise our business and deliver efficiencies into our letters network.

Segment performance

Our parcel services business is again the key driver of growth, delivering year on year revenue uplift of $112.8 million, or 3.6 per cent. Underpinning this result was an improved online retail market, organic growth from our current customers and new customer wins leading to business and eCommerce-driven volume growth of 4.1 per cent. This growth has been achieved despite the significant and intensified competition from both local and global players.

The continuing take-up of digital technology and the changing needs, behaviours and expectations of our customers continue to impact our mail services business, resulting in a 1.7 per cent decline in revenue. This decline is mainly due to 7.3 per cent fewer articles sent this year in Addressed Letters, and in particular a 10.3 per cent decrease in Ordinary Letters. This is partly offset by the full-year benefit of the Basic Postage Rate increase in March 2014 and state elections in Victoria, New South Wales and Queensland.

Performance in our retail and agency services business remains flat, with a slight revenue decline of 0.9 per cent. We have seen positive results from a 17.7 per cent year-on-year increase within the growing products within this portfolio, particularly financial and identity services, offsetting the revenue declines in our traditional products.

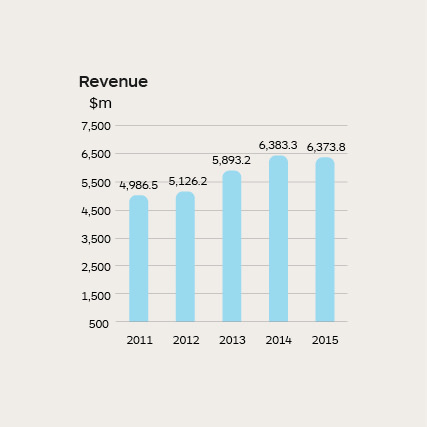

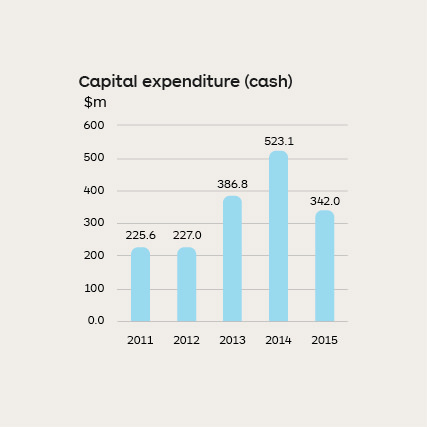

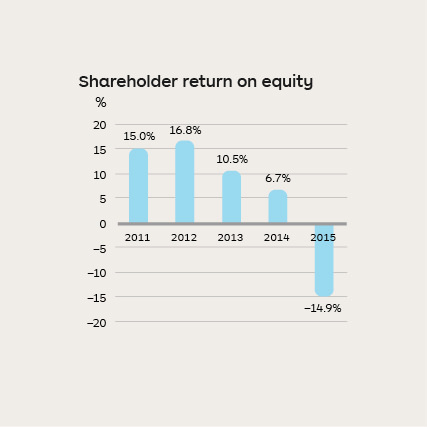

Five-year trends

| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

| Revenue ($m) | 4,986.5 | 5,126.2 | 5,893.2 | 6,383.3 | 6,373.8 |

| Profit / (loss) before Tax ($m)(2) | 332.3 | 366.7 | 210.7 | 103.0 | (352.1) |

| Profit / (loss) after Tax ($m)(2) | 241.2 | 281.2 | 177.4 | 116.2 | (221.7) |

| Profit / (loss) from reserved services(2) ($m) | (66.5) | (114.4) | (198.0) | (242.6) | (283.4) |

| Return on equity (%)(1)(2) | 15.0 | 16.8 | 10.5 | 6.7 | (14.9) |

| Return on average operating assets (%)(2) | 10.9 | 11.5 | 6.2 | 3.4 | (8.2) |

| Debt to debt plus equity | 23.6 | 29.1 | 27.3 | 28.8 | 27.2 |

| Dividends declared ($m) | 173.2 | 213.7 | 192.7 | 78.8 | - |

| Interest cover (times)(2) | 10.9 | 10.8 | 7.7 | 3.6 | (10.2) |

| Reserved services letter volumes (m) | 3,738.8 | 3,545.3 | 3,305.7 | 3,173.5 | 2,942.5 |

(1) Return on equity is calculated as profit / (loss) after tax as a percentage of equity. Equity has been adjusted to remove the impact of the Group’s net superannuation liability / asset.

(2) Changes to AASB 119 Employee Benefits took effect on 1 July 2013. Year 2013 has been restated for like for like comparison. Years prior to 2013 have not been adjusted to reflect the changes as a result of this change in accounting standard.

Outlook

Australia Post will need to adapt to the changing needs of consumers, businesses and government as we embrace the evolution of the digital economy. At the same time, we will continue to manage the challenges brought by the structural decline in letter volumes and customer visitations, as well as the increasingly competitive parcel segment.

With the Government’s support for reform of our letters business, our focus will be on implementing the transformation to our letters services to meet changing customer needs and create a more efficient network.

While our Parcel Services business is expected to continue to deliver revenue and volume growth, domestic and international competitors are changing the competitive landscape within the parcels segment. Our focus will be to drive cost and service leadership to ensure we maintain and grow our market share across business-to-consumer and business-to-business deliveries; providing more choice and convenience to make it easier for businesses and consumers to buy, sell and deliver.